Mutual Funds

Mutual Funds

A mutual fund company brings together money from multiple investors and invests the same in securities like stocks professionally managed by the fund manager appointed by the Asset Management Company.

A portfolio represents combined holdings of mutual funds from different mutual fund schemes in line with ones financial goal and risk taking capacity.

A mutual fund is both an investment and an actual company. A mutual fund holds a large number of securities in order to provide the benefit of diversification at a low price to the mutual fund holders.

Consider an investor who buys Hindustan Unilever stock, he stands to lose a great deal of value since all his investment is tied to only one company. On the other hand, a different investor invests in mutual funds that happens to own some Hindustan Unilever stock. When HUL has a bad quarter, the latter will lose significantly less than the former.

Terms Associated with Mutual Funds

| Terms | Description |

|---|---|

| AMC | A company that runs a mutual fund is called an Asset Management Company. Example – Axis Mutual Fund, Reliance Mutual Fund. |

| AUM | Assets under management is the total market value of investments managed by a person or entity on behalf of clients. |

| Annualized Returns | Rate of return for a given period of time that may be less than or more than a year but computed as if it was return of 1 year. |

| Asset Allocation | Appropriate distribution of funds among different asset classes like equity, debt or gold. |

| Credit Rating | It is an opinion of the ability and willingness of a company, government or individual to pay back the debt issued. AAA rated debt is good and BB is not good. |

| ELSS | Equity linked savings scheme are special mutual funds that are exempt from tax under section 80C. |

| Exit Load | If a investor exits the scheme before a specified time mostly 1 year. It can be up to 1% for some schemes and some schemes don’t have exit load. |

| ETF | Exchange traded funds are like mutual funds but bought and sold on stock exchanges. These funds have lesser expense ratio than mutual funds. |

| Face Value | Face value is the original price or par value for stocks. It is a nominal value as stated by it’s issuer in case of mutual funds. In case of bonds the maturity amount is known as face value. |

| SIP | Systematic investment plan is the most easy way for a common man to enter the stock market. It is a plan where periodic payments are regularly made to a mutual fund. The investment can be as small as 500. |

| SWP | Withdrawal of a fixed or variable amount of money from the investment made in mutual funds may be monthly quarterly or yearly. |

| STP | Transferring periodically a sum of money from one fund to other but both the funds should be managed by the same AMC. |

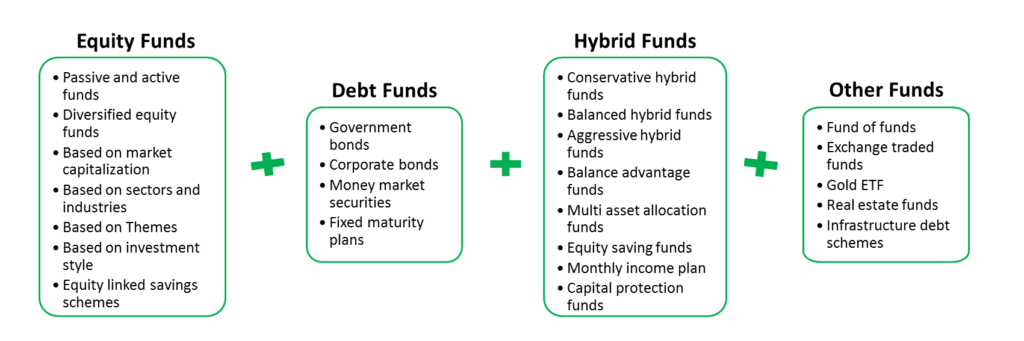

What are types of Mutual Funds?

>> Equity Funds – An equity fund is also known as stock fund that invests in equity securities of different companies. A systematic investment plan (SIP) in an equity mutual fund yields several benefits like diversification, variety to explore, relatively lesser risk than direct investing, professional management and beating inflation.

>> Debt Funds – From various types of mutual funds, the investors who prefer less volatility and fixed income returns opt for debt funds. They take the investors money and invest in fixed income securities like bonds, treasury bills, etc. Mostly debt funds are rated for credit quality by credit rating agencies.

In other words, mutual funds with investments lower than 65% in equity instruments are known as debt funds. In case of debt funds, short term capital gains are taxed corresponding to the investor’s income tax slab and a rate of 20% on long term capital gains after indexation is applicable. The tax is applied if the amount of profit earned is more than Rs 100000.

>> Hybrid Funds – These funds invest in a combination of debt and equity securities. The allocation to these asset classes depends upon the investment objective of the scheme. The risk and return will largely depend on the allocation of the scheme between equity and debt and how they are managed. A higher allocation to equity instruments will increase the risk and the expected returns from the portfolio.

Similarly, if the debt instruments held are short term in nature for generating income, then the extent of risk is lower than if the portfolio holds long term debt instruments that shows more volatility in prices.

Investor Service Standards

SEBI has prescribed the turnaround time of various transactions that an investor makes, they may be financial or non financial in nature. The regulations also specify the information that mutual funds must surely provide investors within the said time frame.

| Information | Time Period |

|---|---|

| Allotment of units in NFO | 5 days from closing date |

| Scheme opening for continuous transactions | 5 business days from allotment |

| Confirmation of unit allotment by SMS or Email | 5 days from purchase application |

| Dispatch of consolidated account statement | End of every month if there is a transaction in the folio. Else every 6 months. |

| Dispatch of account statement | 5 days from request |

| Dispatch of dividend warrants | 30 days from dividend declaration |

| Dispatch of redemption proceeds | 10 business days from redemption request |

| Daily NAV of scheme | Available by 9:00 pm on mutual fund and AMFI’s website |

| Monthly portfolio disclosure | At the end of the month on mutual fund’s website on or before 10th of following month |

| Unaudited half-yearly financial results and portfolio |

Within 1 month of closure |

Taxation of Mutual Fund Products

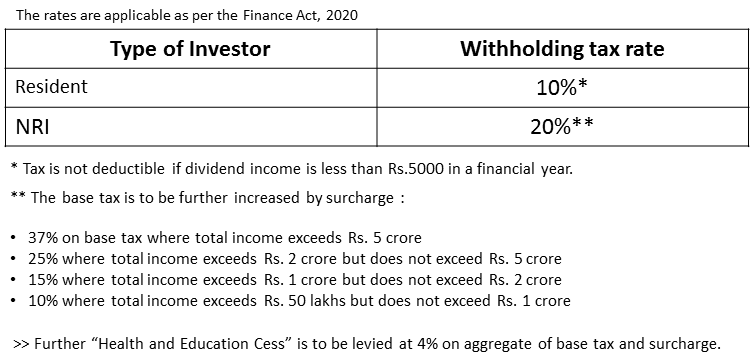

When it comes to mutual funds, the returns are received or realized by the investors either in form of dividends paid by the mutual fund to the investors or as capital gains when the units are redeemed by the investor. These returns are taxable in the hands of the investor when they are received depending upon the nature of the investment, the period of holding the investment and type of investor.

1. Tax on dividend – Earlier according to the Finance Act, 2019 the amount of dividend received by investors from mutual funds is exempt from tax i.e investors do not pay tax on any dividend income received but the mutual funds pay a dividend distribution tax (DDT) before paying out the dividend to the investors.

The investors indirectly bear the tax since it is paid out of the surplus that otherwise would have been made available to them.

But the Finance Act, 2020 abolished the income distribution tax and introduced taxing of income from mutual funds in the hands of unit holders.

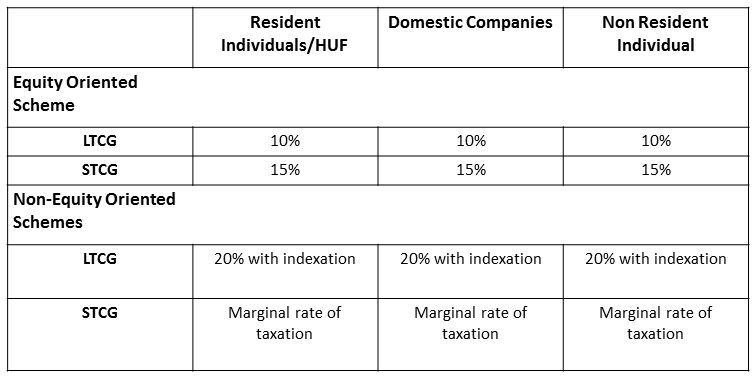

2. Tax on Capital Gains – Capital gains tax applies to the gains realized on redemption or sale of units. The rate of tax will vary depending upon the nature of capital gains : short term or long term.

Also, the tax on capital gains depends on the type of fund. In case of equity-oriented funds, if the units were held for not more than 12 months before they were redeemed, the gains are considered short-term capital gains (STCG), else it is long term capital gain (LTCG). For non-equity oriented funds, the gains are categorized as short term capital gains if the units are held for not more than 36 months before redemption, else it is long-term capital gains.

The LTCG tax of 10% is applied when the profit earned is above 100000. Investors can set-off a capital loss on sale of investments against taxable gains made on other investments further reducing the tax to be paid. This is called set-off and if a capital loss cannot be set-off against a capital gain of that particular year, it can be carried forward for the next 8 years.

3. TDS on Capital Gains – The investors who are resident individuals are not subjected to TDS on stocks and mutual funds whereas NRI’s are liable to pay TDS on capital gains from mutual funds. NRI investors alone have tax deducted at source at the rate of 15% for STCG and 10% without indexation for LTCG in equity-oriented funds and the rate of 30% (assuming the investor falls into highest tax bracket) and 10% without indexation for unlisted 20% after indexation for STCG and LTCG from non-equity oriented funds. This TDS cannot be claimed back.

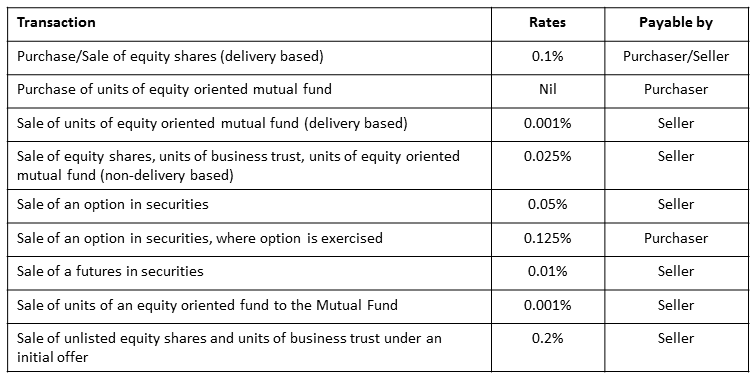

4. Securities Transaction Tax (STT) – It is a tax levied at the time of purchase and sale of securities listed on stock exchanges in India. The tax rate of STT differs based on the type of the security traded and whether the transaction is a sale or purchase.

@Gourav Ahuja

Hi, I am a Web Master at Taxation Wealth. I use content management systems to combine and enhance the outcomes of different people to establish the most optimal website for the creator as well as the end user. Also, from more than 5 years being a financial controller I have been speaking the language of business.