In this digital era, getting a health insurance may have become a simple piece of work but in order to dodge all the misconceptions in the way one needs to have access to correct and factual data.

With such a huge increase in the number of lifestyle diseases, health insurance has become the need of the hour. The increase in medical inflation day by day is known to everyone but actually acknowledged by very few of us. In this increasing age of competition, increasing stress is a issue faced by all resulting in major health problems sooner or later in any individual’s life.

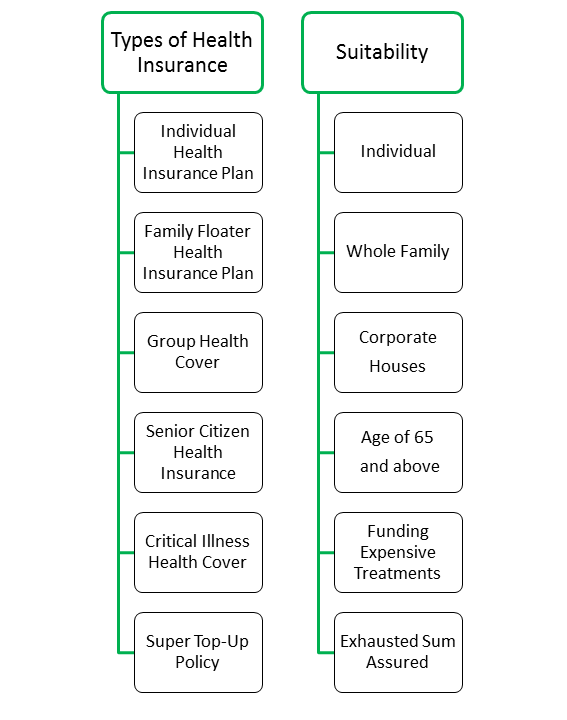

Below chart highlights types of health insurance available and suitability of each type for different people.

India is undoubtedly one of the most fastest growing economies of the world but still a huge basket of people consider health insurance just as a tax benefit to avail at the end of the year. The primary purpose of health insurance is to protect you from financial instability by acting as a shield in front of unknown expenditure that knocks your door.

Benefits of buying a Health Insurance Policy

1. Maternity Benefit – For being financially stable. It covers delivery expenses of a new born baby as well as it’s first 90 days for protection from any complications or vaccinations required. Cover for lawful termination of pregnancy is also covered.

2. Alternative Treatment – Ayurveda, Homeopathy or Yoga.

3. Transportation Charges – Ambulance charges.

4. No Claim Bonus – No claim is filed in previous year.

5. Domiciliary Treatment – Treatment taken when confined at home under medical supervision.

6. Pre and Post hospitalization Charges – Up to the period of 60 days, depending on the policy.

7. Tax Benefit – Under section 80D.

8. Cashless Treatment – Due to tie-ups between insurance companies and hospitals.

9. Attendant Allowance – For kids or elderly disabled people who need help in daily activities.

10. Free Medical Checkup – Generally after 4 to 5 claim free years.

11. Daily Hospital Cash Allowance – Expenses such as food and traveling, the amount increases in case of ICU or accident cases.

12. Dental Treatment – In some policies it is covered once after a few years with sub-limits.

13. Weight Loss Surgeries – For obese patients having life threatening conditions, usually has a waiting period of 2 to 4 years.

Why employer provided health insurance is not enough?

Below are the reasons why you must opt for a separate insurance policy rather than one provided by your company.

>> Standardized sum assured – Different employees have different needs and the total coverage comes around 2 Lakh if you are lucky.

>> Co-pay clauses – Only a part of expenditure is covered by insurer.

>> Coverage depends on employment status – The moment you leave or on termination, the insurance cover ceases to exist.

>> Non Portable – No claim bonus cannot be carried forward if you want to switch.

>> Just a tool to retain employees – The insurance provided by the employer is just a perk not your right that you can exercise when you need to. It can be pulled by the employer for cost cutting or any other reason without any legal complication for the company.

>> No Tax Benefit – Under section 80D the tax exemption available up to Rs 25000 and Rs 50000 for senior citizens cannot be availed.

>> Room rent limit – The room rent covered under the policy provided is not mostly enough and ends up burning a hole in your pocket.

>> Post retirement coverage – After retirement you won’t have the insurance coverage and getting one at that age won’t be as good and easy as it may seem to be at the moment.

>> Change in Terms and conditions – It often takes employees by surprise in the time of need to find out that they are now not getting what they actually signed up for because the company had some cost cutting to do.

Health Insurance Companies in India

There may be plenty of companies providing insurance policies to fulfill the needs of different individuals but finding the best health insurance company often ends up being a headache.

| Index | Health Insurance Companies |

| 1. | Aditya Birla Capital Health Insurance |

| 2. | Star Health and Allied Insurance Company Ltd |

| 3. | Future Generali India Insurance Company Ltd |

| 4. | Bajaj Allianz Health Insurance |

| 5. | Manipal Cigna Health Insurance Company |

| 6. | IFFCO Tokio General Insurance Company Ltd |

| 7. | New India Assurance Health Insurance |

| 8. | Max Bupa Health Insurance |

| 9. | United Insurance Health Insurance |

| 10. | Reliance Health Insurance |

Hi, i am a gamer. I play with words. I believe in persistence no matter how hard or cumbersome the path of perfection may be and due to this constant urge of achieving what i want people often think me to be abnormal but according to me i just don’t get embarrassed easily since i am already maxed out.