Life Insurance

To convince you to buy life insurance policies some brokers often stress upon insurance being an investment as the policy has monetary value that can grow over time.

"Insurance is a product and not an investment"In order to determine the size of the insurance policy required, a large number of experts and brokers usually suggest 10-15 times of current income.

Using a more personalized method like DIME for estimating the actual amount of insurance required can be way more beneficial.

Life insurance is a contract that helps the policy holder to be financially prepared for uncertainties. It also secures the family members of the policy holder in case of any unfortunate incident like accident or untimely demise leading to a major effect on the amount of income generated.

The two certain things that are bound to happen one way or other are death and taxes. Both can be delayed by making smart efforts and decisions time to time.

Among other important things to consider in case of life insurance below mentioned are the primary concerns :-

- Earlier the better (Lesser premium costs)

- Name multiple beneficiaries.

- Review periodically (At least once per year)

- Evaluate all the premium payment options

- Double check the lock in period

Why do i need life insurance?

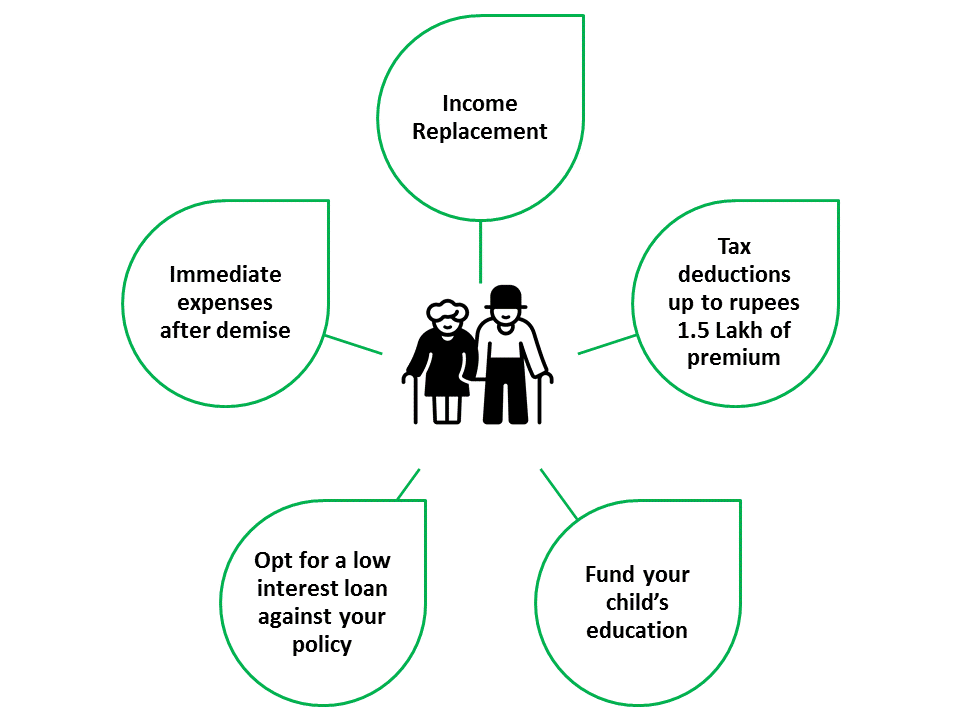

No matter who the person is, at some point of life every individual encounters certain questions in his/her life. Questions such as what am i leaving for my family, will my family be able to survive with the legacy i am leaving behind or whether my child can achieve the standard of living he desires without me around.

What are the types of life insurance?

A vast variety of life insurance policies are available to cater the needs of different individuals.

1. Whole life – Insurance cover for entire life or up to an upper age limit of insured with a fixed amount of premium. The financial benefits from to the insured will be the sum assured, guaranteed additions or bonus if any. In case of a unit linked plan the fund value will be paid on maturity/death. Major disadvantages are premium inflexibility and less competitive internal rate of return.

2. Term life – Term life insurance policies have low cost and are often known as pure risk cover insurance policies. Such plans involve a fixed period of time, mostly 10-30 years and have a predetermined cover amount.

3. Level Term – Same premium every year.

4. Increasing Term – Lesser premium at young age as compared to premium amount as age increases.

5. Single Premium – One time premium payment is made up front by the policyholder.

6. Endowment Plans/Guaranteed Return – Life cover with guaranteed returns. Lump sum amount is paid to the policyholder on maturity and the cover amount is much lower in such policies.

7. Money back – Certain amount of sum assured is paid to the policyholder at fixed intervals.

8. Market linked Plans/ULIP – Combines protection and investment. The returns depend on the performance of the market and the plan also provides an option to choose a fund mix to the policyholder based on his desired asset allocation.

9. Universal life/Variable Insurance Products – Combines insurance and investment but are not unit linked. Minimum policy term is 5 years and lock in period is 3 years.

Important : Each policy is unique to the insured as well as the insurer. It's utmost necessary to go through your policy document and understand what risks your policy covers and what benefits it actually provides to the beneficiaries at maturity.

What are different life insurance riders?

Insurance riders are nothing but just add-ons to the basic insurance policy.

Double sum assured rider – The amount of sum assured is doubled if death happens due to particular reasons such as accidental death.

Critical illness rider – Provides a sum equal to twice the sum assured in case of any life threatening illness.

Accident or disability rider – A periodic payout in case of temporary disablement.

Waiver of premium rider – In case of disability or loss of income, no need to pay the pending premium amount.

Guaranteed insurability option rider – Enhancing the insurance cover without further medical examination.

Hi, i am a gamer. I play with words. I don’t have much qualities but the ones i have are often cherished. I believe in persistence no matter how hard or cumbersome the path of perfection may be and due to this constant urge of achieving what i want people often think me to be abnormal but according to me i just don’t get embarrassed easily since i am already maxed out.