Income Tax

Whether a Resident Indian or a Non Resident Indian who earns income in India has to pay income tax. The income earned could be income from salary, pension or the interest of an amount just lying in the savings account you opened when you turned eighteen. Even, reality show winners like Prince Narula of Big Boss have to pay tax on their prize money.

The taxpayers in India are categorized as Individuals, Hindu Undivided Family (HUF), Association of persons (AOP), Body of Individuals (BOI), Firms and Companies.

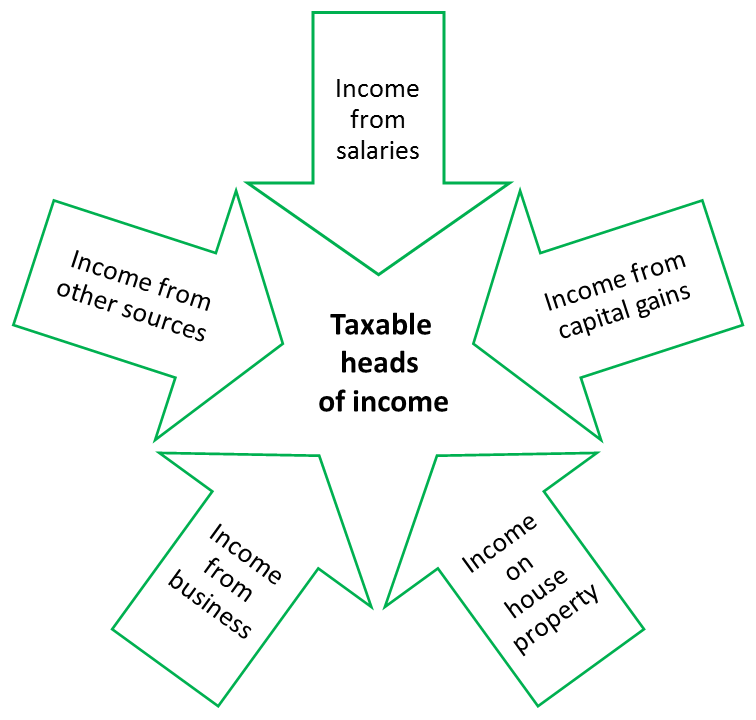

The source of income may be regular or irregular, every individual is required to file his income tax return. Doesn’t matter if it’s taxable or not. Not all income is taxed slab wise. Their are certain exemptions according to the Income tax Act 1965 like exemption on capital gains.

Collection of Income Tax

The tax is collected primarily in three ways by government of India.

- Tax Collected at Source (TCS)

- Tax Deducted at source (TDS)

- Voluntary payment by different tax payers

Return Filing

For filing income tax returns, several forms are provided in the Income Tax Act,1965. Through the prescribed forms income earned by an individual as well as the amount of income tax paid are informed to the Income Tax Authority.

| Forms | Description |

|---|---|

| ITR Form 1 | When a person receives regular pension or salary or an income from residential house property or other sources. |

| ITR Form 2 | For those who come under the category of HUFs and have income from other sources except profits from business and profession. |

| ITR Form 3 | For HUFs falling under the category of business and profession. |

| ITR Form 4 | Applicable to HUFs and Individuals who are proprietors or professionals. |

| ITR Form 4s | The form is also known as SUGAM, is applicable to HUFs and individuals opting for SUGAM taxation scheme as per 44AD/AE. |

| ITR Form 5 | Applicable to firms, LLPs, AOPs, BOIs and local authorities. |

| ITR Form 6 | This form is for companies that claim no exemptions as per section 11 of Income Tax Act. |

| ITR Form 7 | For people who need to file returns as per Sections 139(4A), 139(4B), 139(4C), 139(4D) |

Important sections to save tax in India

- Section 80C

- Section 80CCD (Employer NPS 105 of Basic Salary)

- Section 80D (Health Insurance)

- Section 80E (Interest of Education Loan)

- Section 80EE (Home Loan Interest Rs 50000)

- Section 80EEA (Housing Loan Interest Rs 50000/- for 1st time buyer)

- Section 80EEB (Buying of electric vehicle Rs 1.50 Lakhs)

- Section 24 (Home Loan Interest Rs 2 Lakhs)

Taxation of NRI in India

An Indian citizen who resides outside India for more than 180 days in preceding financial year is a Non Resident Indian. The taxable income of Non Resident Indians is covered by the following points.

>> Salary received in India or salary for service provided in India.

>> Income from a house property situated in India.

>> Capital gains on transfer of asset situated in India.

>> Income from fixed deposits or savings bank account in India.

>> Interest earned on an NRE account and FCNR account is tax-free. Interest earned on NRO account is taxable for an NRI.

>> Income from business and profession.

>> Income earned outside India is not taxable in India.

>> Income from capital gains.

NRIs can avoid double taxation by seeking relief from DTAA between the two countries. Under DTAA there are two methods to claim tax relief :-

a) By Exemption Method, NRIs are taxed in only one country and exempted in another.

b) In Tax Credit Method, where the income is taxed in both the countries, tax relief can be claimed in the country of residence.

@Gourav Ahuja : Hi, I am a Web Master at Taxation Wealth. I use content management systems to combine and enhance the outcomes of different people to establish the most optimal website for the creator as well as the end user. Also, from more than 5 years being a financial controller I have been speaking the language of business.