Financial Planning

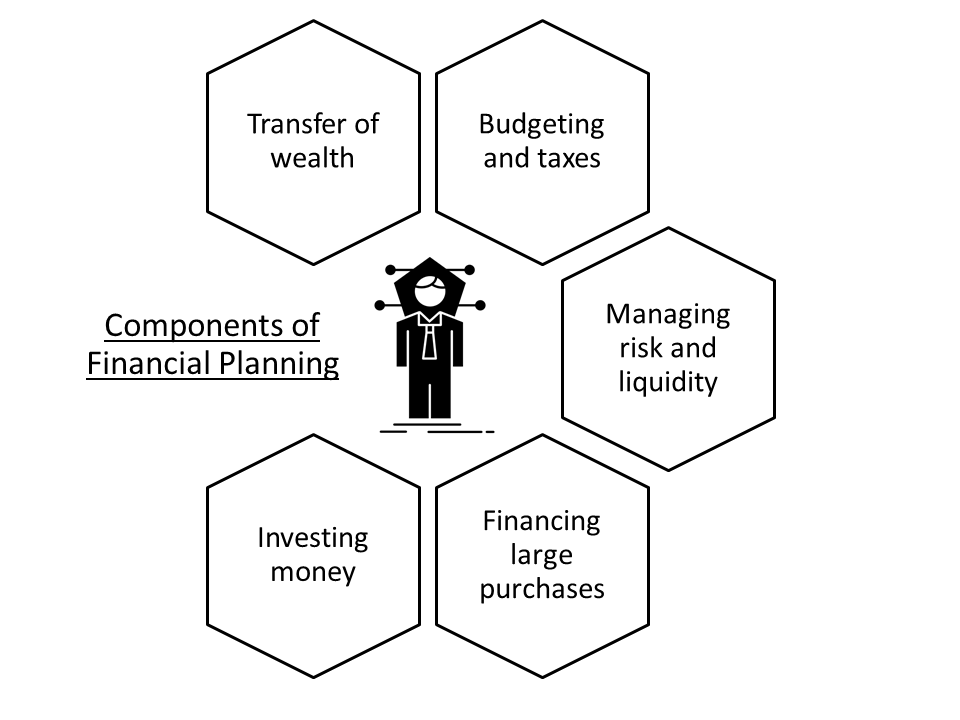

Financial Planning is something that helps to achieve numerous goals at different life stages of an individual in a systematic manner. It is an exercise to evaluate current and future financial standing of an individual.

It covers determining the capital structure required to fulfill long term and short term needs while maintaining the best possible debt-equity ratio.

A finance manager creates a road map and helps you to meet all your life’s expenses whether expected or unexpected. From choosing the right investment medium and determining the appropriate asset allocation of the funds to comfort the retirement years, a financial manager does it all.

People often wonder do they actual need financial planning since they have saved enough working all their life. It is actually right if the money is invested wisely to achieve future goals till the bug of inflation knocks the door.

Inflation is simply a rise in price of a good or service over a period of time. Suppose an item which costs you Rs 500 today can cost you Rs 550 tomorrow. Now think what it will cost you on your retirement?

Role of a Financial Planner

1) Raising funds – By maintaining the appropriate debt-equity ratio.

2) Proper allocation of funds – For proper allocation a financial manager needs to be aware of the size of the firm, it’s growth capability, the kind of assets it has (short term or long term) and the medium through which the company raises it funds.

3) Profit Planning – Profit is something everybody wants, it is severely affected by factors like fixed costs and opportunity cost.

4) Knowledge of Capital Markets – Some companies believe in distributing profits as dividend rather than using it for growth of the concern but investors often don’t like such companies, so the financial manager needs to take care of that aspect too.

Apart from above highlighted points your advisor will enlighten you about various other aspects like whether you need to follow the 50/20/30 rule for dividing your earnings among different heads such as needs, wants and savings or you require a tailor-made ratio.

There will also be in depth discussions between you and your financial planner about which accounts you need to have as well as where to have them. Moreover which insurance policies are actually suitable for you and at what age, taking in consideration all of your financial goals.

Do you need a Financial Plan?

Everybody is not the same, someone likes sweet and the other might like spicy, people are at different stages of their life – one can just be on the verge of graduating and the other can already be a successful business tycoon.

Some of the reasons why you may need financial planning are unplanned expenditure, multiple liabilities leading to a debt trap, scattered investments leading to confusion about which ones you actually need according to your goal, doubtful about choice of investments you made, need of discipline for systematic and regular investment habits, choosing the appropriate life insurance policies from your portfolio or if the portfolio stresses on a single asset class like equity or gold.

Why Financial Planning?

All the above details may make an impression that financial planning is just for rich people but on the contrary even if a middle class individual opts in and manages to get a sound financial plan in place, he might end up being wealthy in the end instead.

So, whether you may be running a startup, a successful business owner or a salaried individual working with the hope of getting a raise this month for sure – Financial Planning is a must.

>> Don’t wanna go through all the hassle yourself ? Let us help you : Reach Us

Hi, i am a gamer. I play with words. I believe in persistence no matter how hard or cumbersome the path of perfection may be and due to this constant urge of achieving what i want people often think me to be abnormal but according to me i just don’t get embarrassed easily since i am already maxed out.